Selling a Promise - Insurance Agencies

At John O’Meara’s funeral many people spoke to his daughter, Molly, of the things John had done for them. The most heart-rending stories took place during the Depression. As an insurance agent (and a congenial, social person), John had contacts in many places, including in the Michigan government. He got jobs for people at Jackson Prison and even created jobs at his agency, preserving the dignity of men who wanted to provide for their families, not take a hand- out.

John o’meara

John attended Hillsdale College, where he was president of the Alpha Tau Omega fraternity. Called John “Irish” O’Meara, he was gleefully followed by his friends when he cooked up each batch of mischief. His high spirits a part of his personality, as an adult he became a member of a poker group called the “Checkered Vest Club,” an interesting name for a man who was colorblind. John was a close personal friend of Win Schuler, the well-known restauranteur. Going to Schuler’s restaurant was one of Molly’s favorite memories because the family could always count on Schuler himself coming to their table with a treat just for them. But of all his involvements, John’s greatest devotion was given to his faith. He was a regular parishioner at St. Anthony’s Church and tipped his ever-present hat to it each time he drove by. At home, in private, he prayed on his knees morning and night.

After graduating from Hillsdale College, John established a nine-hole golf course in the Irish Hills where the twin towers sit on US-12. It was an accident on that highway that turned him toward becoming an insurance agent. That pathway fulfilled his sincere desire to be of service to others. He opened an office on Broad Street and became the salesperson for several companies that sold car and home insurance.

Molly went on to teach kindergarten near Chicago in Deerfield, Ill., where she met Ed Sumnar, who was working at Dun & Bradstreet. They married in 1964 and moved with all their belongings to Hillsdale in a two-car/one U-Haul convoy with Molly’s parents, John and Karolyn O’Meara. Ed began working at the insurance agency owned by his father-in-law on April 1,1965, the day after the memorable Palm Sunday tornadoes, and quickly learned why insurance is essential. He began his career dealing with catastrophic claims, including the first total loss of that event. It was the Baw Beese Lake house of Will (“Red”) and Charlotte Farquharson, owners of Wilchar Cleaners.

Through the next 37 years, Ed’s considerable ability to care for and empathize with others helped him serve the community. Having begun his profession as an employee of his father-in-law, he ended it as an employee of his son Chris. Like his father, Chris began his adult life in Chicago, in his case as a trader on the Chicago Board of Options, before moving into insurance. Chris had seen the important work his dad had done helping people through the disruption to their lives caused by unexpected accidents and losses. He purchased the agency from Ed and began work on Oct. 7, 2002.

In 1933 Earl Scholl left behind his early job choices as a farmer, a railroad worker and a thresher operator moving from farm to farm. Keeping his job as a car salesman, Earl opened an insurance agency from his home. It soon grew to the point where he and his wife, Susie, moved their agency to one of the two storefronts connected to the Keefer Hotel. Earl took pleasure in developing relationships with his clients, while Susie covered the financial side of the business.

susie and earl scholl

The two Scholl sons, Larry and Bob, joined the agency, Larry shortly after WW II and Bob after graduating from Tri-State College (now Trine University). As had their dad, the boys enjoyed their interactions with clients and were of service to their community. Larry sat on the Hillsdale City Council in the late 1960s, and Bob never missed a Kiwanis meeting in 60 years. He did that even while away from Hillsdale by locating a Kiwanis group to attend on the established day.

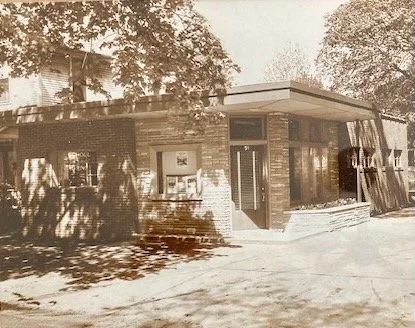

Larry and Bob took over the Scholl Insurance Agency in 1954, acquiring an old gas station to remodel on the corner of Howell and Barry streets. (In the 1970s they purchased the house on Howell next to the agency to have control over who would be so close to their location.) Although not working with clients anymore, Earl still drifted in to chat occasionally, maintaining that habit well into his 80s when his grandson Ron and granddaughter Kathy owned the agency.

the scholl insurance agency

In 1973 Michigan led the nation in the revolutionary idea of “no fault insurance.” This meant that each driver’s auto insurance provider automatically paid for damages to their car up to a specified limit, regardless of who was at fault. This was in contrast to the tort insurance system, in which one driver was found at fault for the car accident. The move to “no fault” required that Michigan insurance agencies needed to confer with each of their clients to explain the new law and to help them make informed choices on the type of insurance coverage they wanted. It was a stressful time, and Larry’s already-high blood pressure was taxed. He died suddenly in September of that year.

Bob’s workload doubled. Larry’s daughter, Kathy, still in high school, spent time at the agency doing paperwork to help ease the burden on her uncle Bob. After high school she earned her insurance license and began to work there as an agent. Bob’s son, Ron, seven years younger than Kathy, chose to go to Ferris State College, graduating in 1981 with a degree in business with an emphasis on insurance. Shortly after he joined the agency, he and Kathy Scholl Proctor signed an agreement with Bob to purchase the agency in five years. The two cousins got along well, each having their own strengths that together benefited their clients. They tried to think “outside the box” and were trendsetters in using an electronic management system to increase the efficiency of processing claims. Their forward thinking allowed 300 to 400 claims to be quickly and efficiently processed in 1993 when a disastrous hail storm in Osseo and Pittsford left homes looking like they had been used for rifle practice.

Ron and Kathy would have loved to see Ron’s children and/or Kathy’s stepchildren interested in carrying on the family business. None of them did. Kathy retired, and in 2013 Ron felt the need to plan for his own retirement. He began talks with Chris Sumnar about a merger. It wasn’t a simple matter. Each of them needed the many carriers they worked with to agree to the merger. Eventually the logistics were in place to establish the Sumnar-Scholl Insurance Agency (with the order of names chosen by a flip of the coin). The merger came with an agreement that Chris would buy Ron’s share of the agency in five years.

In the 1940s John T. Dean sold insurance and real estate on Monroe Street in Coldwater. His wife, Teresa, sold real estate with him, and their sons each followed one side of the family business. While Greg chose to sell real estate, Jeff went into the insurance business. John and Jeff had a new building erected on West Chicago Street in the 1960s, which is where Jeff’s stepdaughter, Michelle Scheetz, began her insurance career. Michelle’s entry into the business began when she was 20 years old and just laid off from another job. Jeff needed help with answering the phone and filing and suggested that Michelle help out for “a couple weeks.” It didn’t take long for her to know that she had found her career. The work was never dull, with each day bringing something new. She loved the variety, but mostly she loved diving into the clients’ needs. Michelle felt blessed for the opportunity to work with Jeff and for the satisfaction of helping clients determine the best way to protect themselves from the expense of recovering from major home or vehicle problems.

By 2016 Jeff was ready for retirement. Michelle weighed the benefits and drawbacks of buying the business from him. In the end she realized that she loved helping clients, but wouldn’t enjoy the stress of running the agency herself. The Sumnar-Scholl Insurance Agency purchased Jeff Dean’s business, and Michelle remained to continue managing the office in Coldwater. Jeff stayed on for another two years and fully retired the same year as Ron Scholl.

With the merger of three insurance agencies a new name was needed. Chris Sumnar chose Vested Risk Strategies.

Lavilla Clark (Shewman Gillespie) graduated from the Jackson Business College in 1945 and began to work for the Hillsdale County Fire Insurance Company, which was owned by its policyholders. In 1963 three or four of the company offices merged to become South Eastern Mutual Insurance Company. Each agency was independent and owned by the agents. The Hillsdale office was called the Hillsdale Agency, Inc. and was in the basement of the Hillsdale County Courthouse. Initially it had several agent/owners, with Arthur Rose serving as the president and Lavilla as the secretary/treasurer. The agreement among the owners was that as each retired or passed on, the others would purchase their share of the company.

In 1970 Mike Clark, Lavilla’s nephew, was attending Ferris State College with no declared major until Lavilla suggested that they had room for someone new at the agency. Mike returned to Ferris to pursue a degree in business with an emphasis on insurance, just as Ron Scholl had. With the passing of Arthur Rose in 1972, Lavilla became the sole owner of the agency. After working there during the summers, in 1973 Mike joined her after graduation.

The Palm Sunday tornado was financially disastrous for the South Eastern Insurance Company. They limped along for about a decade and then sold out to a company in Pioneer, Ohio, which had no interest in maintaining an office in Michigan. Lavilla and Mike continued at the Hillsdale Agency, Inc. until Lavilla retired in 1992, leaving Mike as the single owner. In 2019 Mike also retired, selling his agency to Chris Sumnar and the newly formed Vested Risk Strategies.

For 95 years an O’Meara or Sumnar—with a Scholl, a Dean and a Clark added through the years—have been giving people the comfort of knowing that a major property loss or auto accident won’t leave them destitute. The promise they sell is to help pick up the pieces when bad things happen.